Three Reasons Why You Should Use Dynamics 365 for Financials?

Dynamics 365 is designed to connect every business function together into a single, easy-to-use platform. As you can imagine, there are a number of ways in which the software’s capabilities can be used, and today we’re taking a look at one of the most popular: Dynamics 365 for Financials.

First, let’s review what you can do with Dynamics 365 for Financials. The application includes features that perform the following tasks:

- Quoting

- Invoicing

- Payment

- Purchasing

- Inventory Management

- Reporting

- Analytics

These are basic financial management functions that every business needs, but the way Dynamics 365 for Financials connects these tasks to a comprehensive, scalable platform is what makes it so valuable. Here are three reasons why we think Dynamics 365 for Financials is an excellent choice for small and mid-size organizations alike.

1. Dynamics 365 for Financials Makes Your Back Office More Efficient

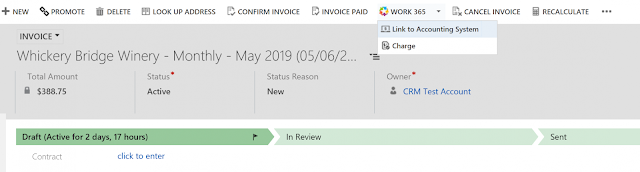

Standalone applications can be slow and inefficient. Dynamics 365 for Financials pulls data from the same system as your sales, marketing, operations, customer service, and other business departments. These connections allow teams to share customer data across departments, quickly send quotes and proposals, follow up on unpaid invoices, and work efficiently with local or distant team members.

Dynamics 365 for Financials also makes use of familiar Microsoft Office programs, making it easy for your employees to perform functions like quoting and invoicing via Outlook. Faster, smoother processes enable employees to quickly perform basic tasks and then focus their attention on more important things.

2. Dynamics 365 for Financials Makes It Easy to Discover Problems & Track ROI

The reporting and analytics capabilities in Dynamics 365 for Financials help organizations paint a complete picture of their sales and spending. Financials unites data from accounting, sales, purchasing, inventory, and customer accounts so that you can see exactly where money is being earned – and where it’s being lost.

At the same time, predictive analytics help organizations model better financial outcomes and avoid wasteful spending. Dynamics 365 for Financials has also made reports easy to create and share so that every member of your team can use real-time data to make important financial decisions.

3. Dynamics 365 for Financials is Ready to Grow with Your Company

When those improved decision-making capabilities pay off and your business starts growing, Dynamics 365 for Financials is ready to grow with your organization. The application is flexible and scalable, with dozens of add-on apps to increase capabilities and connect to popular programs your company may already be using, like QuickBooks, PayPal, and credit card processing services.

Small and mid-sized businesses especially benefit when they have the opportunity to start with a basic platform and scale up as they require more specialized applications. Dynamics 365 for Financials allows organizations to pay for what they need and eliminate wasteful spending on technology that will go unused or unneeded.

Is your company interested in taking advantage of Dynamics 365 for Financials? Contact us today to learn about our special pricing for new Dynamics 365 customers.

Comments

Post a Comment